Size of the Recreational Boat Replacement Propeller Market

Many have suggested the boating industry’s objections to propeller guards may be profit motivated. Some propeller safety advocates and some of those struck by propellers suggest the industry does not want to use propeller guards because guards will reduce the number of dinged up and bent propellers that need replacing. Fewer bent or damaged props would lead to reduced sales of their highly profitable replacement propellers. This post will focus purely on market size, not on motivations.

Propellers have long been known to be an extremely profitable business for the boating industry, and especially for manufacturers of marine drives.As Polson Enterprises, we have been hired several times in the past and paid thousands of dollars to estimate the size of portions or all of the recreational boat propeller market. Just a few days ago, we were asked the same question by a major news network. While we are not going to give away all our secrets for free, we will offer a few statistics here.

Worldwide annual dollar sales are very difficult to make due to the unknown worldwide distribution of boats by engine size AND the many unknowns concerning propeller replacement frequencies outside the U.S..

Even our most in-depth studies were forced to acknowledge nobody knows the size of the U.S. or worldwide market for replacement recreational boat propellers. We just tried to make the best estimates possible based on the data available.

Some Variables in the Replacement Propeller Market

Boat propellers are made from several materials. The ones we are usually the most concerned with are aluminum, stainless steel, and composites.

In general, stainless steel propellers cost the most per propeller, and are by far the most profitable per propeller sold. We previously wrote about similarities between propellers and prescription drugs. The research and investment is made up front. Markups are huge. Once the original investment is recovered, the money really starts to roll in from premium / performance propellers.

When statements are made about boat propeller market size, you need to determine if they are talking about the U.S. market, the worldwide market, propellers made of a certain material, propellers over a certain size, replacement propellers only, OEM propeller sales, propellers built by a specific company, dollars vs. units, etc. Also, it is important to understand where that estimate was made on the economy/new boat sales cycle (for example, new boat sales are currently much lower than they were in the glory days). Buyers of new boats often select the propeller they want (or the dealer selects one for them) when they buy the boat.

Propellers used in shallow water, rivers, and drought stricken areas are more frequently replaced than those used in deep water. Similarly, propellers are often damaged or replaced after major storms and rains put debris in the water and when water levels are very high. High fuel costs means fewer people on the water for shorter durations, leading to fewer propellers needing to be replaced.

The need for replacement propellers is primarily driven by the number of propellers in service and how many hours they are used per year, not by sales of new marine drives.

Stainless steel propellers are typically thinner, run faster, and are more resistant to being dinged up / bent. However, if they are bent or damaged, stainless steel propellers are much more difficult to repair than aluminum propellers (because stainless props are so thin). Thus a stainless propeller is more likely to be replaced than a similarly damaged aluminum propeller. In general stainless steel propellers are thought to make your boat go faster, have a much longer life than aluminum propellers, and command significantly higher prices than aluminum props.

In today’s world, most boat propeller manufacturers use an insert to adapt their propeller to the shaft and mountings used by the various marine drive manufacturers.

When people or companies make statements about the size of the boat propeller market, it is sometimes not obvious exactly what they are talking about with respect to the variables just discussed.

Statements About the Replacement Propeller Market

This section will primarily provide what others have said before. Much of the data is old, but is still provides insights into replacement propeller market size because the number of recreational marine drives in service is reasonably stable.

Among the sources of the statements below are some of our websites, annual corporate reports, prospectus, company press releases, and court cases.

1981 – Mercury Marine documents – we have seen some old Mercury documents saying Quicksilver (their parts and accessories division) sold $20.6 million in propellers in 1981.

1987 – 25 April 2006 – Ard vs. Brunswick, testimony of Richard Snyder, Mercury Marine expert witness against propeller guards, page 309 – when asked to read his previous testimony given several years earlier (December 15, 1987), Mr. Snyder had said that new drives were being sold without propellers, and Brunswick was annually selling two to three times as many propellers as they were drives. He noted, the props they were selling were not necessarily all going on Brunswick drives due to propeller manufacturers competing for a place on all drives.

1988 – 10 June 2009 – Decker v. OMC, Kenneth Beaudry deposition, pgs. 643-650. – Mr. Beaudry, OMC’s Director of Accounting for their Parts & Accessories Division, says 460,000 outboard motors were sold in the U.S. in 1988 (the glory days), OMC sold about 230,000 of those. OMC sold 262,202 propellers that year through accessory sales. These were replacement propellers PLUS any sales for use on new drives 40 horsepower and above. Below 40 horsepower, new propellers were sold through the respective product groups. OMC sold about $20 million worth of propellers in 1988.

April 1993 – “We Build a Prop” Boating magazine. April 1993 – Charles Plueddeman tours Mercury’s manufacturing facility and was told Mercury manufactures more propellers than anyone else in the world, and is scheduled to produce over 500,000 aluminum and stainless steel propellers in Fond-du-lac this year (1993).

1996 – Outboard Marine Corporation (OMC) data from their Trustees file – what appears to be 1996 data shows OMC producing 1100 aluminum propellers per day and 260 stainless steel propellers per day.

2002 – Mercury Marine tour by CarolinaOutdoors – a report on a 2002 virtual tour of Mercury’s stainless steel propeller shop indicated they were making 120,000 stainless steel propellers a year at that time, and as many as 550 per day.

2002 – Michigan Wheel had sales of $33.8 million per a Dunn & Bradstreet report.

30 October 2002 – RingProp Prospectus – “The Directors believe that the worldwide marine leisure market for RingProp is substantial with the biggest single market for registered leisure craft being the United States. The US retail market for new and used boats, motors, engines, trailers and other accessories was estimated to be worth US$25 billion by the US National Marine Manufacturers Association in 2001. The total number of boats registered in the US at December 2000 was over 12 million, with approximately 400,000 new outboard motors sold there every year. Additionally, the Directors believe that a significant percentage of existing registered boats will replace its propeller each year. The Directors believe the retrofit market in the US to be highly important to the Group.”

30 October 2002 – RingProp Prospectus – “Although RingProp’s technology has been under development for nearly 20 years, RingProp is a new company without a trading record. However, the Directors have set a target of 275,000 unit sales in the financial year to 30 September 2005.”

18 November 2002 – RingProp Floated on AIM (stock market in London) – “The market for marine propellers divides into those supplied for new engines (annual sales approximately 400,000 units in the USA and 560,000 in the rest of the world) and those supplied as replacements. This market is estimated as requiring 4 million replacement screws annually on the basis of there being 20 million propeller driven boats in the world that need propellers replaced once every 5 years on average. The USA alone accounts for an annual replacement market of 2.5 million units.”

21 August 2003 – Money AM article on RingProp, using RingProp estimates – 20 million pleasure boats in the world, props replaced every three years, represents an opportunity of at least 1 billion British Pounds.

12 November 2003 – lengthy post in AIM quoted .com investment bulletin board in the RingProp section – says the U.S. generates annual propeller sales of just over half a billion U.S. dollars for boats up to 300 horsepower.

25 April 2006 – Ard vs. Brunswick, testimony of Richard Snyder, Mercury Marine expert witness against propeller guards, pages 308-309 – Mr. Snyder supplied annual Mercury Marine dollar sales data for propellers from 2001-2004.

- 2001- $48 million

- 2002 – $44 million

- 2003 – $42 million

- 2004 – $48 million

- 2005 thru October 2005 – $39 million

3 December 2011 – Mercury Marine website – “Mercury’s Plant 98 is the world’s largest manufacturer of stainless steel propellers, turning out 100,000 world-class products a year, as many as 550 propellers a day. And the variety of stainless steel propellers created here is wider than that of any other prop manufacturer.”

How to Estimate Replacement Propeller Sales

While the best option would be to get the propeller manufacturers (or their trade associations) to supply the data, that option is not available.

That leaves us with at least six basic approaches:

- Look for statements made by industry leaders (such as those provided above) and try to make overall estimates based on them

- Try to build the data from the bottom up by estimating the number of marine drives in service (requires estimating the number of boats in service by drive size, the percentage of them with twins, triples, etc.), estimating percentage splits between drive types, estimating the percentage of drives with aluminum and stainless steel propellers, and estimating the various replacement frequencies based on prop material,drive type, boat location/use, and drive size)

- When estimating U.S. consumption of boat propellers, you can try to estimate total U.S. propeller production, subtract U.S. exports, and add U.S. imports.

- Estimating U.S. sales of boat propellers, estimating the fraction of the world market the U.S. represents, and scaling up the U.S. estimate to a world estimate

- Estimate market share of a major U.S. player, estimate their annual production in dollars or units, and scale it up to estimate total U.S. data

- Find estimates made by others / off the shelf studies or reports on the boat propeller industry

Back in 2004 we ran some online surveys on RBBI.com on the brand of propellers boaters anticipated purchasing as their next propeller based on size of their engine, and on the frequency they anticipated replacing their existing stainless steel and aluminum propellers. Several hundred boaters answered:

- I Own a 49-149 HP Outboard, My Next Propeller Will Be A ? 20 Feb. 2004 – 29 July 2004.

- I Own a 150 HP or Larger Outboard, My Next Propeller Will Be A ? 20 Feb. 2004 – 29 July 2004.

- Average Aluminum Propeller Life Poll Results 21 Jan- 20 Feb, 2004.

- Average Stainless Steel Propeller Life Poll Results 21 Jan- 20 Feb, 2004.

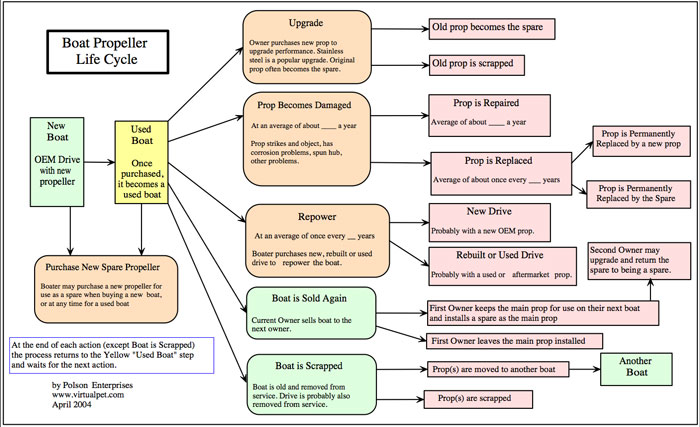

Many boats carry one or more replacement propellers for use in case of failure of the existing propeller. After visiting with countless people in the industry, we drew a Boat Propeller Life Cycle chart to illustrate how propellers tend to flow though the system from being a propeller on a new marine drive to the scrap heap / being recycled.

This is a great article, Gary. Thank you for publishing it! I am wondering if you have any prop data on the following:

1. Percentage of people buying a replacement for a damaged prop vs. an upgrade to an OEM prop vs. a spare?

2. Average life cycle of an aluminum prop?

3. Average life cycle of a stainless steel prop?

4. Percent of online sales vs. brick-and-mortar store sales?

Many thanks for your time. Kyla

Thanks for the compliment. We posted a couple surveys on prop life for aluminum and stainless steel props about a decade ago. The results are linked to just above the Life Chart in the article above.

We have not previously looked into your questions #1 and #4.

Some might argue that not all OEM props are upgrades (saying OEM represents the drive builders), a better question might be upgrading aluminum to stainless or at least adding that piece to the equation.

gary